The Martingale is a method of increasing a position after a losing move, with the goal of recovering losses on the next rebound. The concept originated in gambling in 18th-century France, where players doubled their bet after every loss, hoping to win it all back with a single successful round. Later, this idea found its way into financial markets — replacing bets with trades, and roulette spins with price movements.

The idea is simple: after each losing trade, a new one is opened — with a larger volume.

If the price moves slightly in your favor, the profit from the last trade offsets all previous losses.

In practice, this only works as long as the deposit lasts.

A series of losing trades increases the position size exponentially, and sooner or later it becomes too large for the account to sustain.

Fees and slippage only make the situation worse.

Traders sometimes use the term martingale to describe any form of averaging, but there is a clear difference.

In essence, the Martingale is an aggressive form of averaging, where risk grows proportionally to the trader’s attempt to recover losses faster.

On futures markets, the strategy is especially dangerous.

Leverage amplifies both profits and losses.

A Martingale on futures only makes sense if the trader knows exactly how and where to apply it.

Blindly using it almost always ends in liquidation and a wiped-out account.

On spot markets, the strategy is more common and used in a much softer form.

There is no liquidation or forced position closure, so a Martingale can be applied as an investment averaging method — gradually buying more of an asset during price declines.

This only makes sense if the trader believes the asset has a long-term upward tendency.

For example, many investors buy Bitcoin or Ethereum during dips, increasing their position size to lower the average entry price.

In this context, it’s a Martingale without leverage — effectively a strategy of accumulation.

The reverse Martingale isn’t an algorithm but a risk-management approach.

The logic is the opposite: position size increases not after losses, but after profitable trades.

Scalpers and intraday traders often follow this principle.

They raise their size after a series of winning trades and reduce it after losing ones.

This way, the trader takes on more risk when the market moves in their favor and less when it doesn’t.

Following such a money-management strategy helps the trader not only balance account exposure but also maintain emotional control — there’s no urge to “win it back,” and decisions stay systematic.

It’s dynamic position management, not a grid of preset orders.

Martingale logic is frequently used in grid trading bots (Grid bots, DCA bots, etc.).

These bots place orders along a price grid at fixed intervals and can enable a Martingale mode — where each subsequent order grows in volume.

This allows faster averaging and quicker profit capture when the market pulls back.

Most automated trading bots on the market operate using this logic — either pure grid trading or grid + Martingale. But there’s a downside: when these bots trade futures, a prolonged adverse move almost always leads to liquidation.

That’s why grid bots have a bad reputation — they often drain the account when the market trends strongly in one direction.

This strategy demands a clear understanding of where it can be applied, along with strict limits on position size, step distance, and the number of orders.

Without such controls, automated trading becomes nothing more than a slow-motion margin call.

MoonTrader was not created as a tool for automating simple averaging strategies or grid-based bots.

It’s a professional low-latency (HFT-grade) trading terminal designed for precision control, speed of reaction, and algorithmic flexibility.

Mastering its tools takes time — it’s built for traders who understand the market and design their own trading systems.

That said, Martingale elements are available in MoonTrader — both within algorithms and as part of partial automation in manual trading.

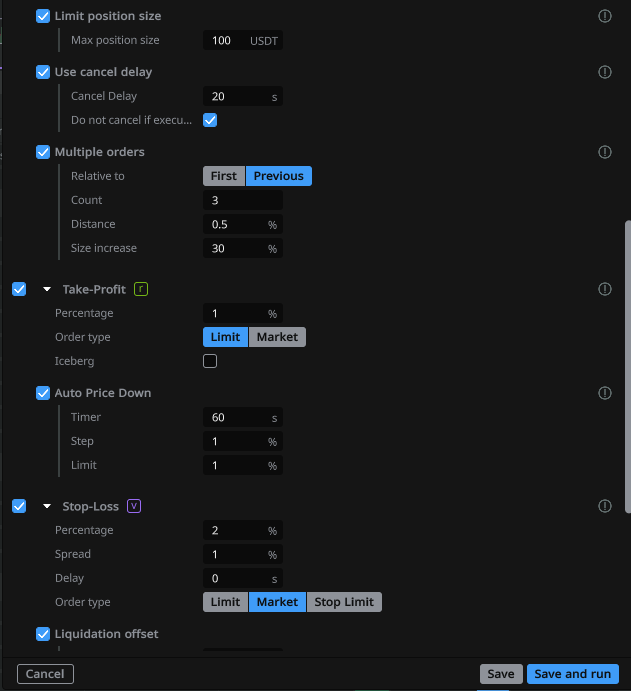

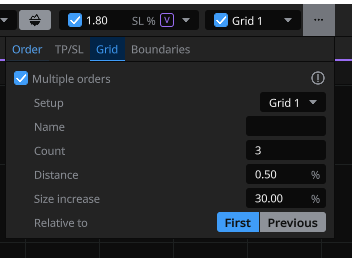

In the Averages algorithm, you can configure:

In manual trading, you can also place your own order grid and, if desired, apply Martingale logic — increasing the size of subsequent orders at a chosen step.

This gives traders the ability to combine automation with manual control, building their own averaging or exit strategies.

In MoonTrader, Martingale is only an option — a tool for those who understand how to manage risk and capital, not the core concept of the terminal.

Check us out on

© 2024 MTSS Development OU, Estonia. All rights reserved.

Disclaimer: Moontrader is not a regulated entity. Trading involves substantial risks, and past performance is not indicative of future results. The profits shown in product screenshots are for illustrative purposes and may be exaggerated. Only engage in trading if you possess sufficient knowledge. Under no circumstances shall Moontrader accept any liability to any person or entity for (a) any loss or damage, in whole or in part, caused by, arising out of, or in connection with transactions involving our software or (b) any direct, indirect, special, consequential, or incidental damages. By using Moontrader's services, you acknowledge and accept the inherent risks involved in trading and agree to hold Moontrader harmless from any liabilities or losses incurred. It is essential to review and understand our Terms of Service and Risk Disclosure Policy before using our software or engaging in any trading activities. Please consult legal and financial professionals for personalized advice based on your specific circumstances.

All trademarks and copyrights belong to their respective owners. MoonTrader ecosystem is a registered trademark of MTSS Development OU, Estonia.